You know, after that really big financial wobble back in 2008, people started thinking, "Okay, how do we make sure that kind of thing doesn't happen again?" And so, in a way, what came about was something called Basel III. It's basically a kind of plan, or a structure if you will, that puts some basic rules in place for banks. These rules are for things like how much money banks need to keep, how easily they can get their hands on cash, how much they borrow compared to what they own, and how they handle risks. All of this, as a matter of fact, was put together to help avoid those past troubles.

This whole Basel III thing, it's actually a pretty full collection of changes. It was put together by a group called the Basel Committee on Banking Supervision, or BCBS for short. Their goal, you see, was to make the rules for banks stronger, to improve how banks are watched over, and to get a better handle on how banks manage their risks. It's really about making the whole banking world a bit more secure for everyone.

The main idea behind this set of financial changes, which we call the Basel III accord, was put together by the BCBS with a clear purpose. That purpose was to make sure that the way banks are regulated, the way they are watched, and the way they deal with potential dangers, all become much more solid. It’s pretty much about bringing more confidence to the financial system, which is something we all benefit from, you know.

- Ai Clothes Remover Review

- Grand Masti Movie Download Filmyzilla

- Filmyzilla Com Hollywood Movies

- Filmyzillacom Bollywood Hollywood Hindi Dubbed Movies Filmyzilla

- Alice In Wonderland Movie Download Filmyzilla Mp4moviez

Table of Contents

- What is Basel III and Why Does it Matter?

- Basel3 - A Comprehensive Set of Reforms

- How Does Basel3 Help Banks Adjust?

- Basel3 - International Participation and Common Rules

- What About Gold's Role in Basel3?

- Basel3 - Ensuring Stability for European Citizens

- Is Your Institution Ready for Basel3?

- Basel3 - An International Regulatory Accord

- How Does Basel3 Tackle Risk?

What is Basel III and Why Does it Matter?

So, you might be wondering, what exactly is this Basel III framework we keep hearing about? Well, it's pretty much a set of rules that lay out the absolute minimums for how banks should operate. This includes things like how much capital, or money, they need to have on hand. It also covers their liquidity, which is how quickly they can get cash if people suddenly want their money back. Then there's leverage, which is, you know, how much debt they take on compared to their own funds. And, of course, it talks about how they manage risks, which is essentially making sure they don't take on too many dangerous bets. This whole structure, you see, came about directly because of the big financial crisis we saw in 2008. It was developed by a group called the Basel Committee, and they pretty much put these guidelines together to try and prevent similar problems from happening again, which is very important for everyone.

Basel3 - A Comprehensive Set of Reforms

Now, when we talk about Basel III, it's actually a really broad collection of changes. These changes were put together by the BCBS, and their main goal was to make the rules for banks much stronger. They also wanted to improve how banks are watched over and how they handle potential dangers. It's a rather full package of reform measures, all designed to make the banking world a safer place. The Basel III accord, as it's often called, is really a set of financial changes that were put together by the Basel Committee on Banking Supervision, or BCBS. The whole idea behind it was to make sure that the rules, the oversight, and the way banks deal with risks within the banking industry were all strengthened. It's about building a more secure foundation, in a way, for financial dealings globally.

How Does Basel3 Help Banks Adjust?

You might be curious about how banks actually manage to get used to these new, rather detailed rules. Well, to give banks enough time to get everything in order and for different countries to actually put these new rules into their own laws, Basel III has been brought in little by little over several years. This phased approach means that banks haven't had to change everything all at once, which is a bit more practical, you know. While many parts of this overall plan have already been put into action, there are still some adjustments happening. This gradual introduction helps make the transition smoother, ensuring that banks can adapt without too much disruption. It's about giving everyone a chance to catch up to the new expectations, essentially.

- Money Heist Season 1 Download Filmyzilla In Hindi 1080p

- How High Filmyzilla

- Jack Movie Download Filmyzilla

- All Marvel Movies Download In Hindi Filmywap

- Inside Edge Season 1 Filmyzilla

Basel3 - International Participation and Common Rules

One of the really important things about Basel III is that it aims for international participation. What that means is that the goal is to have banks all over the world follow a common set of rules. This helps to make sure that banks operating across different countries are all playing by similar standards, which can make the global financial system more stable. It’s pretty much about creating a level playing field, so that banks everywhere are regulated in a consistent way. This international aspect is key because, as we know, money moves across borders all the time, and having shared guidelines just makes sense for everyone involved, arguably.

What About Gold's Role in Basel3?

Now, you might have heard a little bit about gold's place in Basel III. The requirements for Basel III were first made public back in 2010. However, actually getting them put into practice has taken quite a few years. Most of the rules have been in effect since 2019, but it's been a long road to get there. It’s interesting how these sorts of large-scale financial changes take time to fully settle in. The fact that gold has a defined role within these requirements shows how different kinds of assets are considered when we talk about a bank's overall financial health and how it manages its risks. It's not just about cash, you see, but a wider view of what makes a bank strong.

Basel3 - Ensuring Stability for European Citizens

You might also be curious about how places like the European Union make sure that banking stays steady and practical for everyone. And what, you know, are the good things for people living in the EU because of all this? The Basel framework, which is the full collection of standards from the Basel Committee on Banking Supervision, or BCBS, is the main group that sets the global rules for how banks should be carefully managed. This helps to create a more secure environment for banks, which then, in a way, provides more stability for citizens. When banks are stable, people can feel more confident about their savings and the overall economy, which is a really big deal for daily life.

Is Your Institution Ready for Basel3?

So, for institutions, say, in Thailand, a big question might be: Is your organization truly prepared for Basel III? It's a pretty important consideration for any financial establishment. To help with this, there are tools available, like a free checklist for Basel III. You can download this checklist to pretty much see how well you're doing with meeting the rules, figure out any gaps you might have, and then put together a plan for how you're going to get everything in line. It’s basically a way to benchmark your compliance and build an implementation roadmap, which is a very practical step for any bank looking to meet these international standards. It helps them get ready, you know, for what's expected.

Basel3 - An International Regulatory Accord

Basel III is, at its heart, an international agreement on rules. It was put together to make how banks are managed, how they are watched, and how they handle risks, all much better. It’s a collective effort, you see, involving a group of central banks from different countries. This means it’s not just one country making rules, but a whole bunch of them working together to create a common set of guidelines for the banking sector worldwide. It’s about creating a unified approach to keeping banks safe and sound, which is something that benefits everyone who uses banking services, pretty much.

How Does Basel3 Tackle Risk?

Basel III is actually the third in a series of these Basel agreements. It's a framework that sets international standards and minimum requirements for a few key areas. These include how much capital banks must hold, how they perform stress tests (which are like financial check-ups), rules about how much cash they need to have readily available, and guidelines for how much debt they can take on. All of this, you know, is about making sure banks are solid and can withstand tough times. The Basel III accord is really a set of financial changes that were put together by the Basel Committee on Banking Supervision, or BCBS, with the main goal of making regulation, supervision, and risk management stronger within the banking industry. Most of the rules from this accord have actually been in place since 2019, which shows how far along the process is.

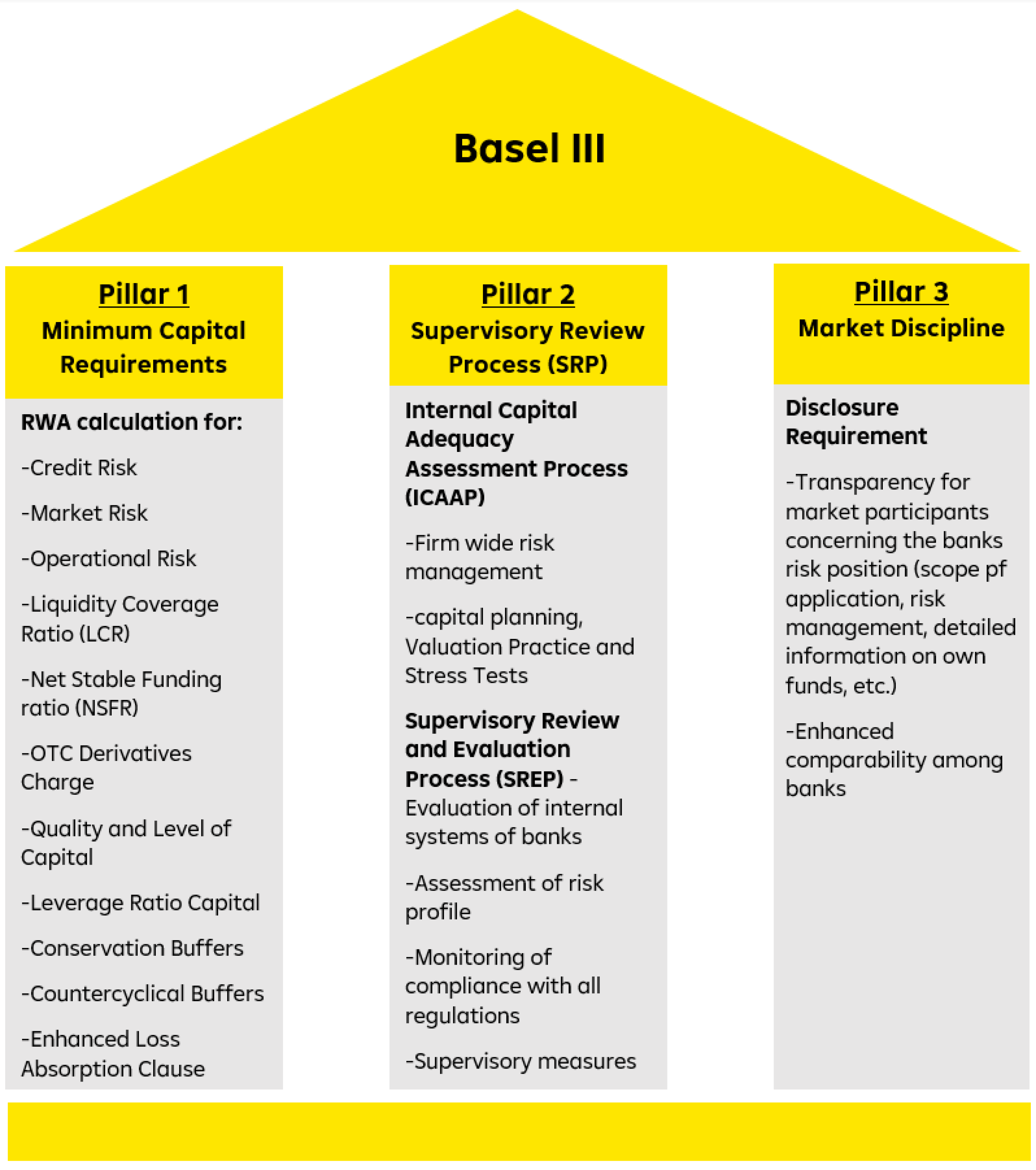

The Basel III framework is a really central part of how the Basel Committee decided to respond to that big global financial crisis. It brought in an international way of dealing with too much liquidity risk – that's when banks might not have enough cash to meet short-term needs – and also how they handle maturity transformation, which is basically when they borrow money for short periods and lend it out for longer ones. They do this through things like the liquidity coverage ratio and the net stable funding ratio. These are basically specific calculations designed to make sure banks have enough stable funding to meet their obligations, which is a very important part of keeping the financial system steady.

Related Resources:

Detail Author:

- Name : Destin Oberbrunner MD

- Username : muller.lue

- Email : legros.ernie@hotmail.com

- Birthdate : 1979-03-04

- Address : 158 Gregorio Shores Port Izabella, AZ 17059-0793

- Phone : (283) 317-1018

- Company : Durgan-Weber

- Job : Stock Clerk

- Bio : Sit et nam consequatur aliquid temporibus. Nesciunt sequi architecto ut quia voluptatem aut commodi. Provident excepturi necessitatibus rerum consequatur.

Socials

twitter:

- url : https://twitter.com/georgianna.ruecker

- username : georgianna.ruecker

- bio : Omnis quae similique consectetur labore. Molestiae est vitae est expedita voluptatem et. Ipsum ut numquam rerum aut modi et sint nihil.

- followers : 4930

- following : 717

tiktok:

- url : https://tiktok.com/@georgianna8574

- username : georgianna8574

- bio : Culpa iusto suscipit harum non distinctio quia voluptates.

- followers : 2264

- following : 2898

:max_bytes(150000):strip_icc()/basell-iii-final-dac3d358ac6847b2b8387ba62d15eb26.jpg)